- Invest with Confidence

- Posts

- [Part 3/3] Does Nvidia deserve its reputation as the AI golden child?

[Part 3/3] Does Nvidia deserve its reputation as the AI golden child?

Is the market giving us a fair price? Decision time.

Welcome back to Invest with Confidence! I take deep technical and financial knowledge, and distill it down to an easy-to-understand report. You won’t need any engineering or financial background to gain a lot of value from this article. I’ll frame all the key takeaways in simple terms so you can understand their significance. By the end, you’ll be able to have an educated, high-confidence opinion on the company.

If you’re new to this publication, I recommend checking out the quick start guide. It’ll tell you what to expect from these articles, and get you excited for what’s to come.

👋 Introduction

It’s time to finish the Nvidia journey. If you haven’t read the first two articles, I recommend you do that first:

Today I’m assessing their valuation to see if the market price is fair. Then I’ll wrap up the articles on Nvidia with my final thoughts on the investment opportunity. Let’s dive in!

Understanding the valuation

Here’s where things become a little more interesting. We’re trying to figure out if the company share price is fair or not. Let’s start with a few valuation ratios to understand where Nvidia stands relative to its competition.

What do the metrics say?

Market capitalization of $2.78 trillion dollars, good for 3rd in the world (after briefly peaking at #1). This is much higher than competitors in its industry (4x Broadcom, 10x AMD). That’s a huge market cap for a company that was largely unknown 3 years ago, and doesn’t sell directly to consumers.

Price-to-earnings ratio of approximately 65. This ratio tells us how expensive a stock is relative to other investment options. (For reference, the S&P average is in the mid-20s. Broadcom is 65, AMD is 202.) The higher the ratio, the more of a premium you have to pay to benefit from the company’s earnings. Ideally you want to find companies that have a low PE. In this case, the PE is very high compared to the S&P, but not high compared to competitors in its industry. To make sense of this, we need to remember that the AI hype has driven the entire semiconductor industry to record highs. The entire sector is overvalued, meaning that Nvidia is only slightly less overvalued than the rest. Overall, a company with a PE this high carries inherent risks.

Quick counterpoint: in 2023 Q1, Nvidia’s PE was 145, an astronomically high number. Since that time, the stock price has tripled. The PE ratio should have increased, right? Nope - the PE is lower now than it was then. The earnings growth has outpaced the price growth so much that the PE actually came down - truly crazy! The takeaway here is that a high PE is a risk, but not always a dealbreaker.

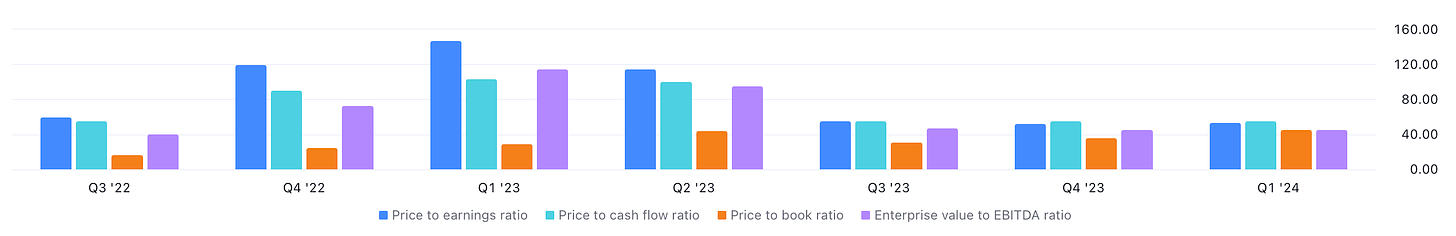

There are other metrics we can look at, such as price-to-cash-flow ratio, price-to-book ratio, or enterprise-value-to-EBITDA ratio. But it would be redundant, they all tell the same story of a company with sky-high valuations, but whose ratios are actually decreasing because of how impressive the earnings are.

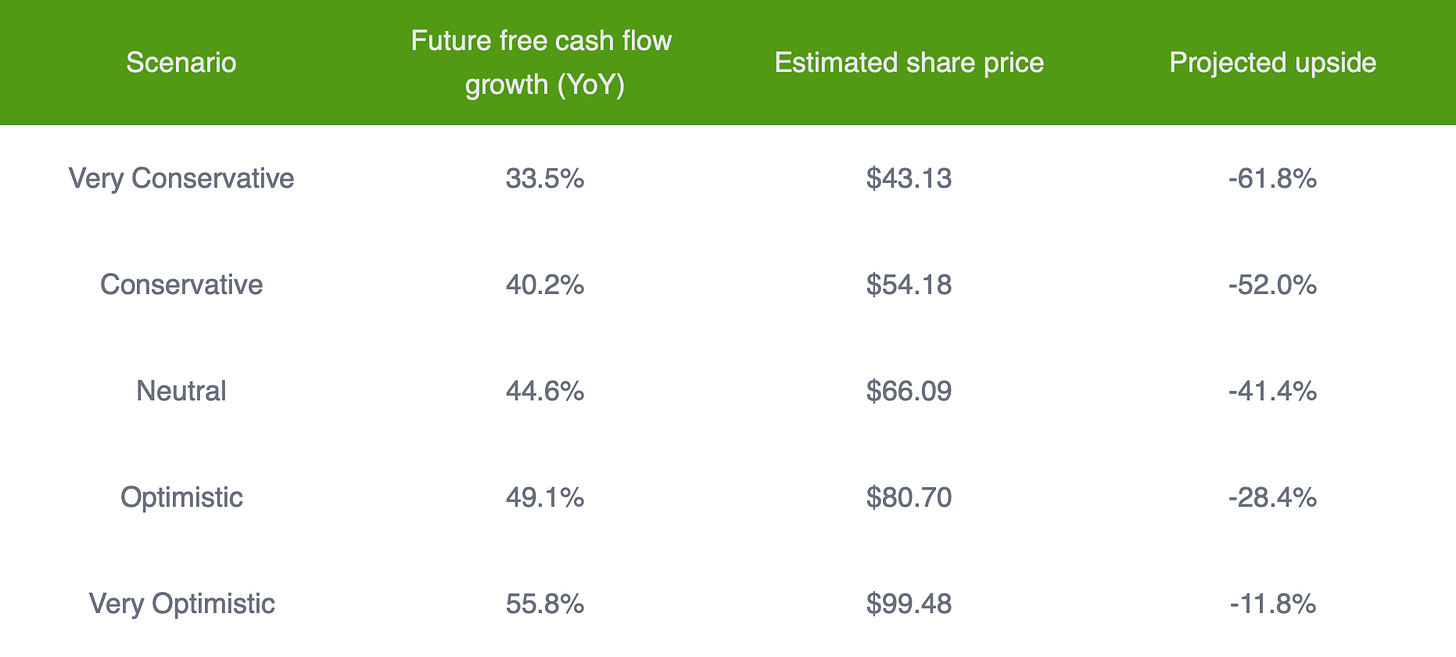

What might the company be worth in the future?

Without going into the nitty-gritty of how this analysis works, DCF estimates the value of a company by projecting its cash flows for the future. I don’t treat it as a definitive price target for a company’s shares, but instead I use it to get a range of possible outcomes. This helps me judge the likelihood of positive growth for the share price. (Note: I’m not laying out the full calculations I did, only the most basic numbers that give the average reader an anchor for each projection. There’s a lot more to it than the table below.)

Even in a very optimistic scenario, where free cash flow grows over 50% each year (keep in mind, this is higher than the insane-hot-streak/world-beating growth rate it’s had), the estimated share price would still be more than 10% lower than it’s current price. This isn’t encouraging. It indicates that so much of this potential future growth has already been baked into the price - in other words, people expect Nvidia to continue growing at crazy rates for the next half decade or more. That puts the share price in a precarious position - the slightest underperformance, and suddenly the price doesn’t seem worth it, and people panic.

What’s a company that had a similar journey?

Let’s compare Nvidia and its place in the AI boom to a similar company during the dot-com boom, Cisco.

Similarities:

Both were selling the proverbial “picks and shovels” of the gold rush. Cisco sold networking infrastructure (routers, switches, etc) that were in high demand as companies started to move online. Cisco was the unquestioned leader in the space (for a time), and anyone who was trying to ride the dotcom wave was dependent on Cisco products. All this sounds exactly like Nvidia today.

Both came out of nowhere to briefly become the most valuable company in the world.

There were huge hype cycles (dotcom, AI) during the times of their ascension where investor craze pushed these companies to be the poster children of their respective revolutions.

Why these similarities are a warning to Nvidia:

After Cisco’s insane run up in stock price, it proceeded to drop by 80% in less than a year. In the almost 25 years since, it has never reached those highs again. The company still exists, and is still a behemoth in the networking sector, but it never exceeded the peak of 2000.

If you had bought it at the top of the hype cycle (unfortunately as many are prone to do), you’d have averaged -2% over the last 25 years, culminating in a near 40% loss.

Created with TradingView

If you had bought Cisco a couple years later, you’d have 5x your investment over the course of 20-some years, giving you a modest 7.5% annualized return. Better than the -40%, but about the same as (if not less than) the S&P return over that same time period, which is a far less risky bet.

From the Cisco annual report in 2000 right before the crash: “In our opinion, the radical business transformations taking place around the world will accelerate, making the opportunities ahead of Cisco far greater than ever before. We believe that Cisco has the potential to be the most influential and generous company in history. We are in the fortunate position to be at the center of the Internet economy.” Famous last words.

Differences:

Nvidia’s financial position is much stronger than Cisco’s was at the time. Notably, Cisco had a much lower net margin, primarily due to high operating expenses. When sales declined following the dot-com bust, Cisco quickly turned in a net income loss, which is a borderline death sentence for a company that had so much optimism baked into its valuation.

Amongst technical folks, Cisco was known as a clunky behemoth that moved slowly and sold fine (but not amazing) products. When competitors arrived on the scene (see Juniper Networks) with an agile, cost-effective and functionally-comparative offering, Cisco quickly began to lose its competitive advantage. This stands in stark contrast to Nvidia today, whose products are superb and who continues to innovate at an industry-leading rate.

Top level management is very different - John Chambers of Cisco had a sales background, whereas Jensen Huang of Nvidia is an engineer who understands the technical differentiators of his product. Chambers took charge of Cisco only 5 years before the dotcom bust, while Huang has been the founder and CEO for over 30 years. Chambers is your standard executive-rising-through-the-ranks type, while Huang is a fighter who scrapped and clawed for the survival of his company from day one. I believe the background, skillset, and experiences of Huang lend a major advantage to Nvidia.

Conclusion

Nvidia is a wonderful business, making a wonderful product. It’s the unquestioned leader in the space, yet it continues to innovate and push the boundaries of what’s possible. It has a visionary and effective leader in Jensen Huang. Its financials are healthy to the point of being almost unbelievable. In a vacuum, I’d love to own as much of this business as possible.

But there are risks. The current valuation, and thereby the current stock price, are so excessively pumped up because of AI hype that the slightest misstep in earnings could cause the company’s valuation to come tumbling down. There could be plenty of runway for the price to increase further, but betting on that will require incredible levels of optimism.

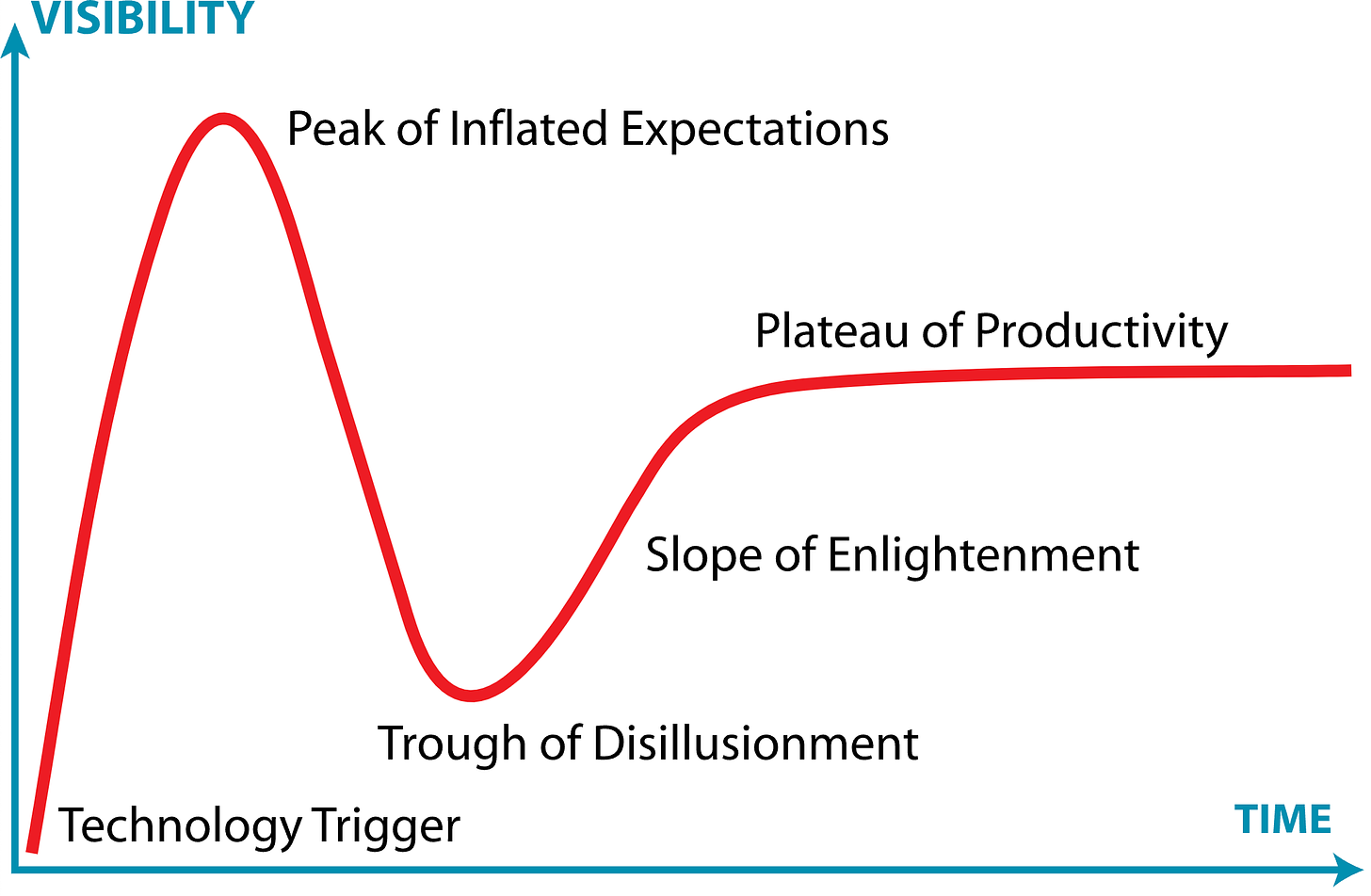

When it comes to AI, I believe that we are at the “Peak of Inflated Expectations” phase of the Gartner Hype Cycle. I expect a correction, during which most of the so-called “AI” companies will disappear, similar to the dotcom bust when a majority of “Internet companies” folded up shop. But similar to the post-dotcom-bust, the companies that survive the AI hype cycle will be the ones that provide true value, and those companies will grow massively. I see Nvidia as being one of those companies that survives - and I would compare its trajectory more to the cloud service providers of AWS and GCP, more than Cisco.

TLDR; I see long-term value and growth in Nvidia’s future, but I have a hard time justifying buying more shares at its current price. I plan to hold my current position and add to it once a correction happens. I’ll re-evaluate, and share my findings, after their earnings call on 8/28.

Agree? Disagree? I’d love to hear from you - share your comments below!

⚠️ This is not investment advice.

Reply