- Invest with Confidence

- Posts

- [Part 2/3] TSMC is the business you've been looking for

[Part 2/3] TSMC is the business you've been looking for

Financial analysis reveals a surprise. We need to investigate.

Welcome back to Invest with Confidence! I take deep technical and financial knowledge, and distill it down to an easy-to-understand report. You won’t need any engineering or financial background to gain a lot of value from this article. I’ll frame all the key takeaways in simple terms so you can understand their significance. By the end, you’ll be able to have an educated, high-confidence opinion on the company.

If you’re new to this publication, I recommend checking out the quick start guide. It’ll tell you what to expect from these articles, and get you excited for what’s to come.

👋 Introduction

Let’s pick back up with TSMC. Last week, I talked about their product and tech here:

It was clear that TSMC demonstrates excellence in their engineering and manufacturing. I have no concerns on that side of the house. Today, I want to look at their financials. Let’s dive in!

Understanding the financials

A basic explanation of financial terms

One common bit of feedback that I received on the first article - I used financial terms that people weren’t necessarily familiar with. To address that, let’s talk about financial analysis in simplified terms.

If you were judging your own personal finances, how would you decide whether you’re in a healthy place? Personally, I look at three basic metrics:

Do I have a consistent, dependable income stream? In other words, am I bringing home a salary? The larger the salary, the better.

Am I making effective use of that money? In other words, am I saving a good portion of my paycheck? Am I managing my expenses well and living below my means?

Do I owe money anywhere? In other words, do I have credit card debt? Or a large mortgage? A car payment?

Personal finance can be that simple - and it’s the exact same strategy that I apply to looking at the financial health of a business. Think of a business like you would yourself - is it making money consistently? Does it have debt? How would you feel if the business income statement and balance sheet were your own statements?

The value of each metric by itself is not as important as the collective picture that’s painted1 . I want to answer, at a high level, “Is the business financially solid?”

Looking at fundamental numbers

With that context in mind, let’s take a look at TSMC’s metrics and see what they tell us:

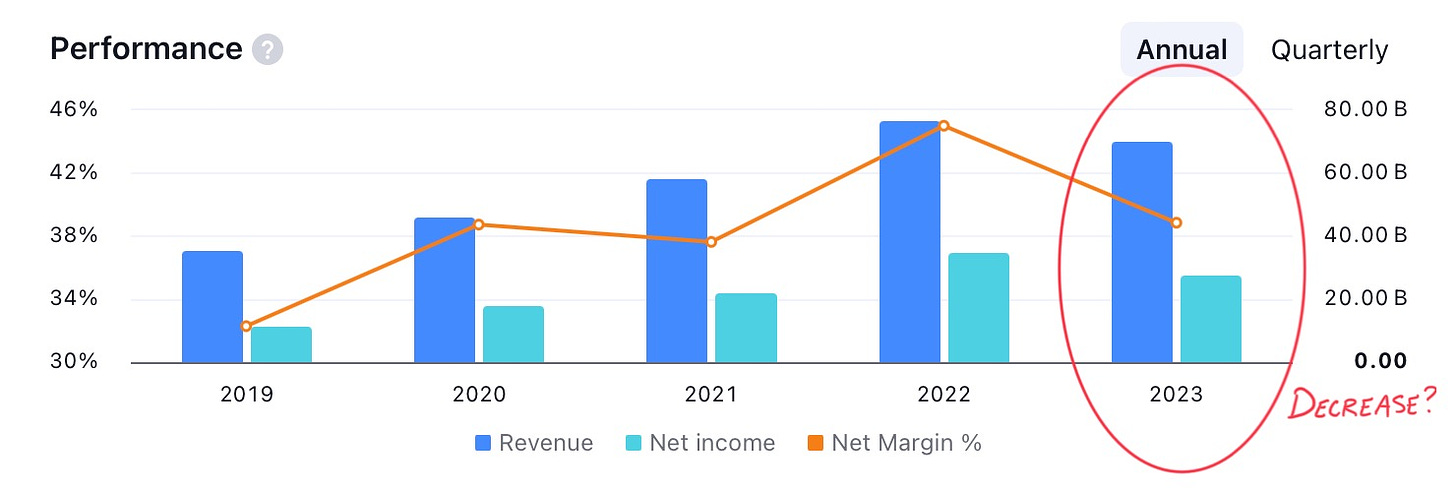

Revenue has more than doubled in the last 5 years, increasing from $32 billion to $76 billion. For the most part, it’s been consistent growth - except, in 2023 TSMC had less revenue ($69 billion) than its 2022 peak.

Net income and earnings-per-share (EPS) tell the same story. Net income grew from $11 billion in 2017 to $34 billion in 2022; EPS from $2.17 to $6.58. I like that their processes are scaling. Net income is growing proportionately to revenue, which is encouraging for future growth. Like revenue, there’s a dip in 2023 (down to $27 billion for net income, $5.19 for EPS). There’s clearly a trend here, which raises the question of what happened in 2023.

Gross margin and net margin are consistently excellent. This was implied in the above section about net income, but to take it a step further, I see gross margin percentage in the high 40s, low 50s. Net margin percentage in the high 30s. These are excellent numbers; for comparison, Intel’s latest net margin is 3% and Samsung’s is 5%. Consider that TSMC makes a physical product, has a highly complex engineering process, and basically no margin for error in its production. With that perspective, it’s really impressive to see these margins. It gets me really excited about how well the company is positioned for future growth.

Debt numbers are healthy. Net debt is negative, and increasingly negative, as the company continues to have more cash on hand. Its debt-to-equity ratio has averaged about 25% for the last 3 years, which is higher than its 2017-2019 average of about 13% but still a healthy number that doesn’t cause any concern. (For a baseline, the average debt-to-equity ratio amongst semiconductor manufacturing companies is around 35%.) This is against the backdrop of significant capital expenditures for the new factories in the US, Japan and Europe. My takeaway is that TSMC leadership is conscientious of their expansion and is managing finances appropriately to mitigate downside risk. This is highly encouraging - I love to see this type of responsible fiscal leadership.

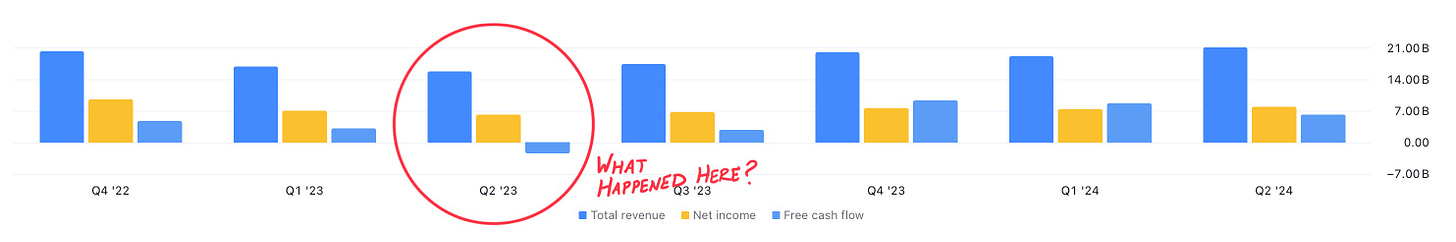

Free cash flow (FCF) highlights the concern from 2023. FCF, for the most part, trends in the right direction and mirrors the overall growth of the company. If we switch from an annual view to a quarterly view, suddenly the outlier becomes obvious - 2023 Q2, which had a negative FCF.

2023 Q2 warrants a deeper dive. Something changed for TSMC during that quarter, and it’s important we understand what the change was, before we consider investing in the company.

However, there’s a bit more good news that becomes apparent when looking at the quarterly financial metrics. Following 2023 Q2, TSMC’s financials rebound to the healthy growth and positive trend that we’d come to expect. We see it continuing into 2024 Q2, the latest period for which there are financial results. I’m encouraged that the area of concern is largely limited to a single quarter, as opposed to a potential new trend that started in 2023 and carried forward.

A closer look at 2023 Q2

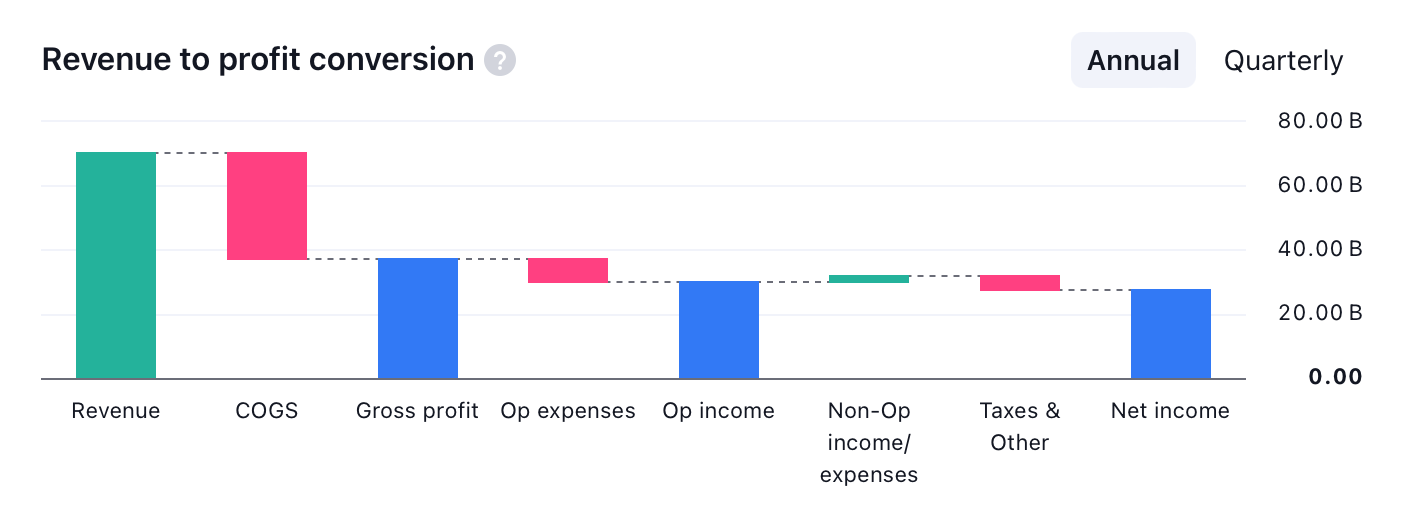

Everything about the performance dip in 2023 Q2 stems from the decreased revenue. The drop in revenue cascaded to reduced net income, negative FCF, and all other metrics that derive from top-line revenue.

So why did TSMC have less revenue that quarter? Let’s turn to the company investor letters to find the answer.

In the 2023 letter, TSMC says that the year’s challenges manifested in fewer sales. They shipped 12 million wafers instead of the 15.3 million they shipped in 2022. That’s the entire dip - that’s the Q2 correction. What was the explanation for fewer sales? TSMC says it was due to a “semiconductor industry inventory correction”. In other words, they’re saying it’s a macro event that the company was caught in, not a strategic or operational misstep.

I was able to validate that by looking at trends from 2023. Post-Covid unique events were unraveling and returning to normalcy. At the same time, the global supply chain was normalizing and companies were realizing they didn’t have to over-order any more. As a global economy, we were returning to just-in-time order fulfillment. But that left customers with excess inventory and therefore a temporary weakening in demand. TSMC responded to the slowdown by decreasing their production volumes a bit (to prevent the market from getting saturated). That’s what caused the decreased sales, and decreased revenue, and everything else we looked at before.

As a second layer of validation, I looked at the financials and investor relations reports from TSMC’s key customers. The stories line up. In quarterly reports, they address the inventory correction and supply chain normalization. Based on this info, I felt confident that the root cause had been correctly identified.

The big takeaway from this section is that, while Covid itself is a one time event, there can be other major unpredictable events that exacerbate the cyclical nature of the chip industry. It would be smart to assume that there’ll be other quarters where TSMC has depressed sales as customers correct for previous ordering.

The positive news is that even after an event as major as Covid, the sales hit lasted all of one quarter. One quarter! By that time, customers had eaten through their inventory and resumed their normal ordering, and TSMC’s financials returned to their growth trajectory. This gives me confidence that the company will be able to effectively respond to cyclical events in the future without panicking or overreacting.

Historical performance

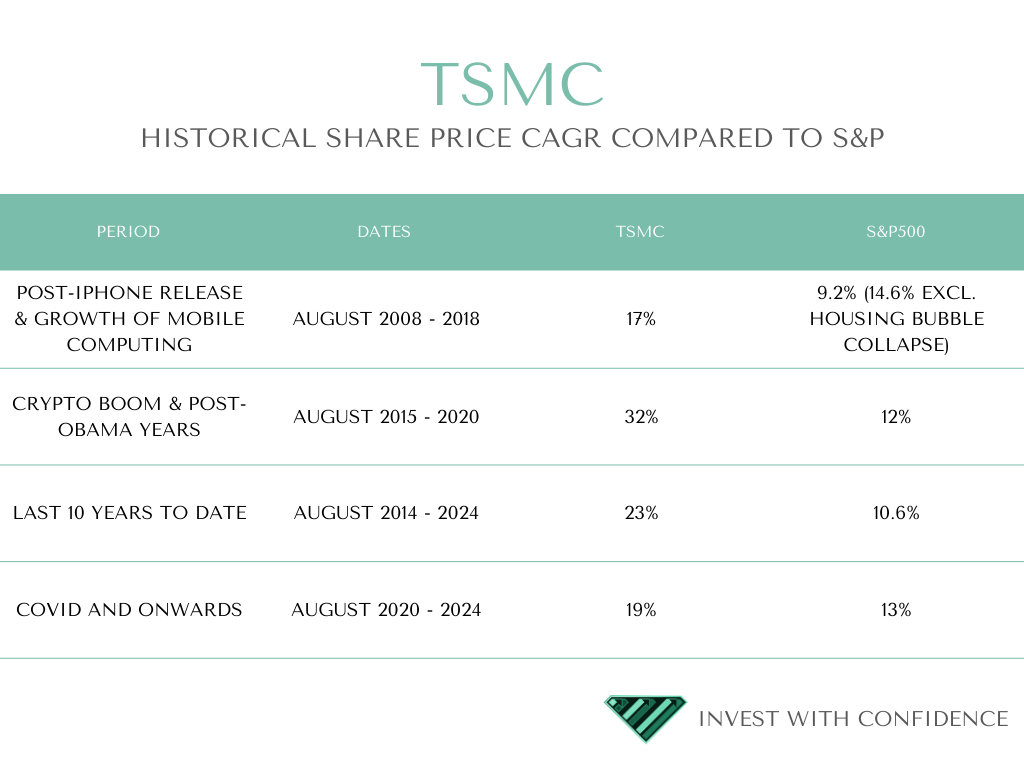

TSMC has had consistently impressive growth in their share price. I looked at their compound annual growth rate (referred to as CAGR) over various periods and compared it to the baseline S&P500 returns:

Since being listed in 1994, the company has delivered a 17.7% revenue CAGR and a 17.2% earnings CAGR. These are awesome numbers. It’s easy to see why TSMC has consistently outperformed the S&P500.

I’m sure most readers have heard the phrase “past performance is not indicative of future returns”. Why, then, am I bringing up the historical performance of the stock? Because I believe these numbers show how TSMC performed with both tailwinds (iPhone, crypto, AI) and headwinds (global recession, Covid, geopolitical uncertainty). I believe that we’re still in the nascent stages of AI, so I expect that particular tailwind to continue for the next decade, at least. Statistically we can also assume there’ll be one major headwind event in that same time period. While these events are unpredictable, I like the track record I’ve seen from TSMC in the past. I’m not assuming that the past performance will be the same in the future, but I am assuming that their leadership and financial management will be similarly competent in the future.

Takeaways from the financials section

Overwhelmingly, TSMC’s financials are very healthy. They’re making a lot of money, they use their money efficiently, and have effectively managed their debt during a time of capital expenditure. The lone blemish in the last 5 years has an explanation that I find sufficiently comforting. While I expect future corrections because of the cyclical nature of the chip industry, I take confidence in the financial management that TSMC leadership has exhibited over the last 30 years.

All news has been excellent so far. I’m really encouraged by what has been uncovered, but there’s still one final step. That’s for next week, when I look at the valuation and see if the markets are offering a fair price. Then it’s decision time!

Continue the journey here:

Thoughts? Comments? Share in the comments below!

⚠️ This is not investment advice.

1 I’m going to write an article that serves as a glossary for commonly used financial terms. I’ll explain more about what you should expect to glean from various metrics. Unfortunately, I didn’t have time to complete it before publishing this article.

Reply