- Invest with Confidence

- Posts

- [Part 2/3] Does Nvidia deserve its reputation as the AI golden child?

[Part 2/3] Does Nvidia deserve its reputation as the AI golden child?

Today we look at the financials. Prepare to be very impressed.

Welcome back to Invest with Confidence! I take deep technical and financial knowledge, and distill it down to an easy-to-understand report. You won’t need any engineering or financial background to gain a lot of value from this article. I’ll frame all the key takeaways in simple terms so you can understand their significance. By the end, you’ll be able to have an educated, high-confidence opinion on the company.

If you’re new to this publication, I recommend checking out the quick start guide. It’ll tell you what to expect from these articles, and get you excited for what’s to come.

👋 Introduction

It’s time to pick back up where we left off with Nvidia and examine their financials. If you haven’t read the first article, you should start there:

It’ll help set the stage for what we talk about today.

Understanding the financials

Let’s look at some basic financial metrics for the company to understand if it’s “healthy”. We won’t get deep into financial jargon, but instead we’ll focus on common-sense numbers that paint a picture of the company’s books.

Are they making money?

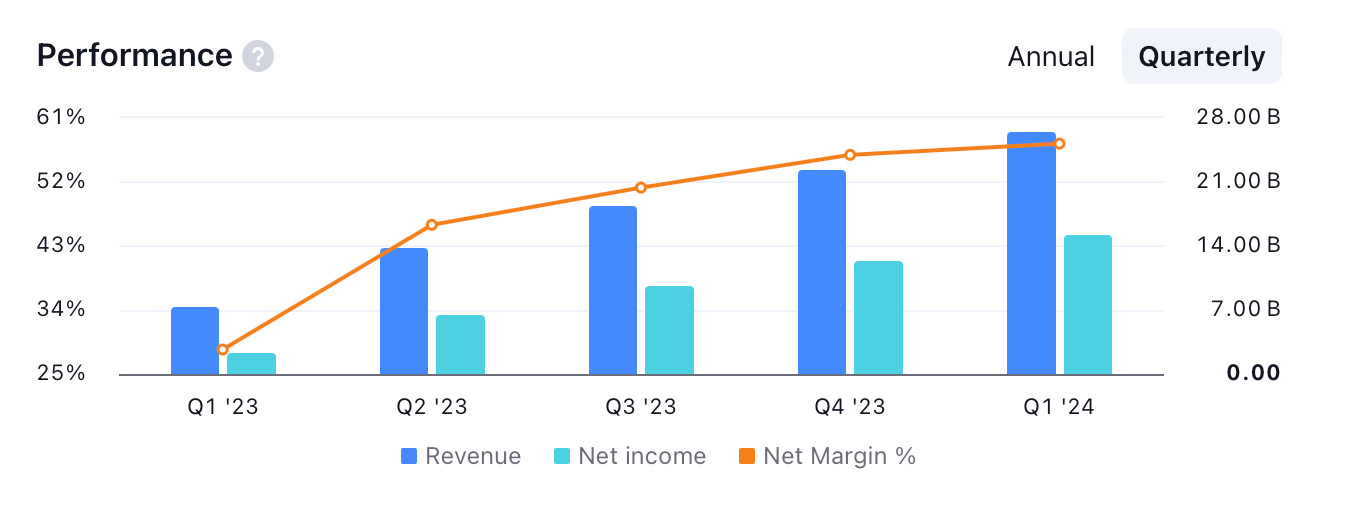

Revenue has been consistently growing each quarter, and is continuously hitting all time highs. The company has averaged 50% year-over-year growth (!!) in the last 4 years; zooming in, they have 30% quarter-over-quarter growth in the last year.

Net income is growing too. In 2023, revenue doubled, but net income grew by a factor of 6x. That means they’re keeping a larger chunk of their revenue with each passing quarter. Are their processes become more efficient? It seems like it.

Earnings per share (EPS) grew as well, especially in 2023 (6x growth). If we look at the trailing twelve months (TTM) instead of FY23, then EPS has been even higher, indicating continued growth.

Free cash flow - guess what? Consistent massive growth, with a huge jump in 2023, with the TTM being even higher. I’m a broken record here.

What more can I say? Nvidia is making a ton of money.

Just keeps going up.

Are they making money efficiently?

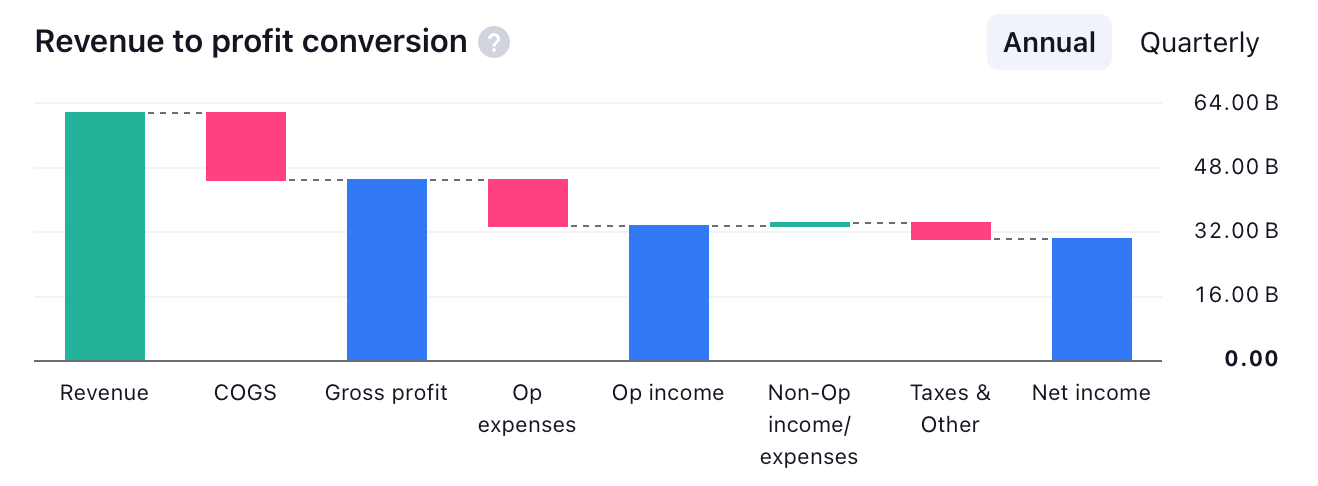

Let’s look at two margins here - gross (revenue minus cost of goods) and net (revenue minus cost of goods, operating expenses, taxes, etc). Both are shockingly high for a company that sells physical products.

Their gross margin has averaged in the mid-60%s for the last 5+ years. It’s actually increased in the last few quarters to the mid-70%s. The business is being run efficiently, and more importantly, it’s scaling really well.

Their net margin has performed well too, averaging mid-30%s for the last 5+ years and also increasing in the last few quarters to mid-50%s. Efficient and scalable.

Couple things worth noting about these margins:

Nvidia’s margins are more impressive than other chip design companies. AMD is nowhere close, while Broadcom has some healthy metrics (but not nearly as impressive as Nvidia).

2022 was a slight dip (albeit not significant) from their continued run of excellence. 2022 was when Nvidia released an updated chip architecture (Hopper), so it makes sense that there was a slight dip in efficiency as they had to deal with optimizing the production and deployment of new chips. With Blackwell coming out soon, I wouldn’t be surprised to see another slight dip in efficiency before returning to world-beating levels.

Nvidia is making a ton of money, and they’re doing it really well.

That is one efficient business.

What are their liabilities?

Net debt is negative, meaning they have far more assets / cash than liabilities. That’s a very strong cash position for any company, let alone one that’s innovating so aggressively.

It’s trending in a positive direction too, with assets increasing by 75% versus liabilities increasing by only 25% over the last 4 quarters.

Short story short, there’s nothing to be worried about in terms of their debt.

Nvidia is innovating without increasing costs - their competitive advantage grows at the same time that they become more efficient. Hard to fathom.

Takeaways from the finance section

The financials of this company are unimpeachable. They’re growing revenue, improving margins, and reducing debt. Their margins and debt numbers are borderline unbelievable when you consider that they’re making hardware products, which typically have lower margins than your standard SaaS company.

They’re somehow doing this while still innovating. Their lead on the competition is growing without them needing to eat into their financial health. Truly incredible.

If I was making a decision purely based on the financial health of the company, I’d buy it in a heartbeat.

But there’s one more thing we have to do before we make an investment decision - look at the valuation of the company. Are we getting a fair price? Are we leaving a margin of safety for ourselves in case things don’t go perfectly?

That’ll be the next article. You might be surprised by what we find. Continue the journey here:

Agree? Disagree? I’d love to hear from you - share your comments below!

⚠️ This is not investment advice.

Reply