- Invest with Confidence

- Posts

- [Part 1/3] TSMC is the business you've been looking for

[Part 1/3] TSMC is the business you've been looking for

"Foundational tech for the modern digital economy" might not be an overstatement.

Welcome back to Invest with Confidence! I take deep technical and financial knowledge, and distill it down to an easy-to-understand report. You won’t need any engineering or financial background to gain a lot of value from this article. I’ll frame all the key takeaways in simple terms so you can understand their significance. By the end, you’ll be able to have an educated, high-confidence opinion on the company.

If you’re new to this publication, I recommend checking out the quick start guide. It’ll tell you what to expect from these articles, and get you excited for what’s to come.

👋 Introduction

In this article, we’re going to continue exploring the semiconductor industry, a journey we started last month with Nvidia. We saw how it’s an excellent business whose hype has somehow outpaced its otherworldly growth. If you haven’t read it, you should go there first:

Nvidia doesn’t operate in a vacuum, though. They are one piece of a complicated supply chain. This is good news for us, because while Nvidia might be overvalued, there could be opportunities to invest in other parts of the chain. Today, we’ll go further down the supply chain to examine another company that is critical in enabling the latest wave of AI products.

The company I want to talk about is TSMC1 , or Taiwan Semiconductor Manufacturing Company. It’s a very important piece of the semiconductor industry, and arguably is an even more fascinating story than Nvidia. Some of you may be familiar with it already, some of you may have never heard of it. So we’ll start from scratch. As with last month, I’ll follow a progression to build up a comprehensive understanding of TSMC’s value:

Understanding its product and therefore its context in the larger semiconductor industry

Looking at its financials to understand its health

Analyzing various metrics to determine whether it’s overvalued

I’m really excited about TSMC. I learned a lot while researching this company, and I think you’ll find it fascinating too. I’d been curious about the company for a while, but hadn’t done a deep dive. I knew (in a more-or-less abstract way) that it was a linchpin in the supply chain for modern electronics. In general, that’s the type of company I like investing in - one with a defensible moat, one that is relied on by many industries and customers. So I started my research with an optimistic mindset. I was eager to find out, do the underlying facts and fundamentals align with my intuition? Would it justify taking a long-term position?

Let’s dive in.

Understanding the product

What does the chip supply chain look like?

We know that AI products, such as OpenAI’s ChatGPT and Google’s Gemini, need advanced GPU chips to function. And from the last article, we learned how Nvidia’s chips are almost universally relied on. So where does TSMC fit in?

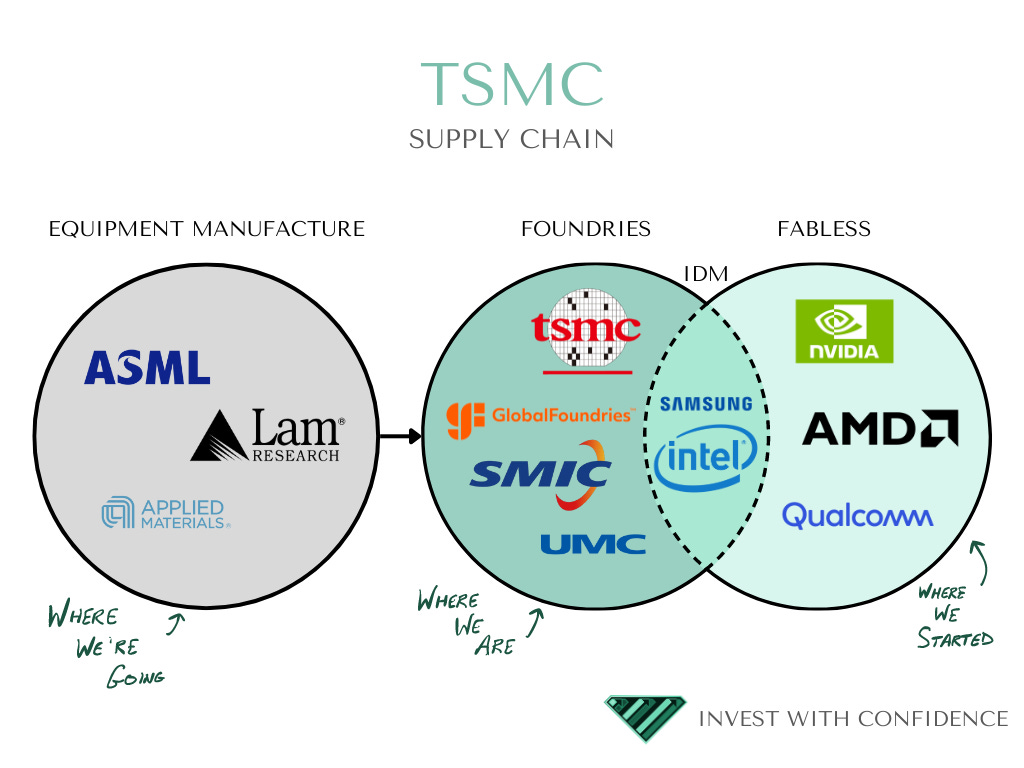

In order to understand the value of TSMC, we need to start with its place in the supply chain. There are three types of companies that contribute to semiconductor (chip) manufacturing:

Fabless. These companies design chips, but don’t actually make them. Nvidia falls into this category, and so do AMD, Qualcomm, etc.

Foundries. These companies actually build the chips. This is the category that TSMC falls into, as well as competitors like Global Foundries, UMC, and SMIC.

Equipment manufacturers. These companies provide tools to the foundries that allow them to actually manufacture the chips. Companies in this category include ASML, LAM, and Applied Materials.2

There are some companies that do both 1 & 2, which are called Integrated Device Manufacturers (IDMs). Intel and Samsung are examples in this category. It’s worth mentioning because we’ll be talking a lot about Intel and Samsung today. Their struggles will highlight how effective TSMC has been.

Key takeaway so far - Nvidia can’t do what they do without foundries to build its market-leading chips. No foundries, no chips, no AI.

How do TSMC and other foundries actually build the chips?

I want to briefly explain how chips are made so that readers understand what a technological feat it is. Here’s a simplified process:

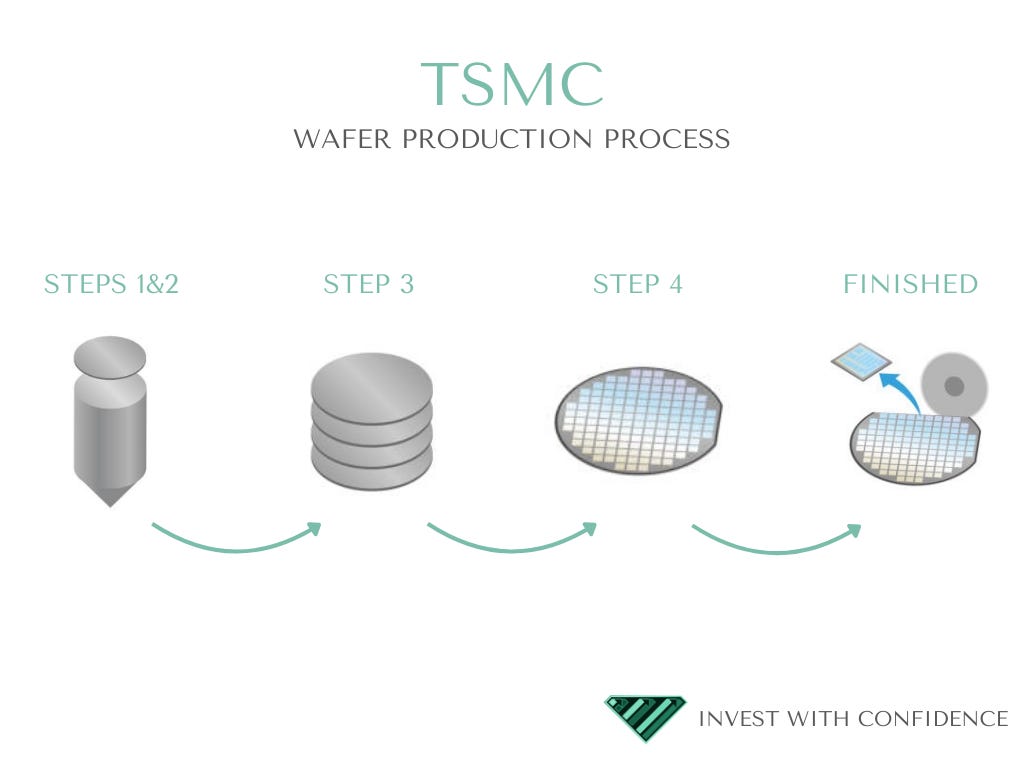

We start with silicon-rich sand. (For what it’s worth, silicon is the semiconductor from where the chips and industry get their name.3 )

The sand is purified and shaped to create a cylinder of pure silicon. The diameter of this cylinder ranges from 1 - 12 inches typically (some highly advanced and rare ones are 18 inches in diameter). The bigger the diameter, the more chips can be made, so it’s desirable to increase the size.

The cylinder is then sliced into very, very thin circular disks called wafers. During this time, there can’t be even a single particle of dust on the wafer. One single particle can ruin the entire batch, which would waste 12 weeks of work. Consider the diameter of the cylinder from the previous step - the bigger the diameter, the more fragile and delicate the wafer will be. So there’s a tradeoff that must be considered.

Various materials are deposited on the wafer, and then it’s exposed to UV radiation in a lithography machine. Parts of the wafer are etched away, leaving behind the three-dimensional microchip that we are familiar with. It takes 4 months to complete a wafer of chips.

It should be clear that this process is highly technical and highly delicate. It’s expensive, time-consuming and tedious. Which is why very few companies in the world even attempt to be foundries. There’s a massively high barrier to entry - tens of billions of dollars up front for specialized equipment and R&D, years until commercial production, a long time without any revenue - and if you get past that barrier, you then have to perfectly execute a highly complex process millions of times a year.

It gets more impressive in a minute, but a quick aside before we get there…

Who is more responsible for the success of the chips, Nvidia or TSMC?

If you read the previous article, you may be wondering how to distinguish between the value provided by Nvidia and TSMC. “I thought Nvidia is so good because they design the best chips, but now it seems like the manufacturing process itself is what’s so impressive,” you may be telling yourself. Good question - let’s use a simple metaphor to break this down.

Consider Formula 1 racing. The biggest winners have a combination of two key ingredients: great cars and great drivers. In this scenario, consider TSMC to be the car manufacturer and Nvidia to be the driver. TSMC can provide the best infrastructure and the best platform, but Nvidia knows to get the most out of it. Nvidia can use the full potential of the platform to deliver results that no one else can.

If a great driver (Nvidia) is in a 1970 Toyota Camry (not TSMC), they’ll never win a single race no matter how good they are at driving.

If I’m the driver (decidedly not Nvidia) in McLaren’s state-of-the-art racer (TSMC), I won’t win a single race because I can’t properly utilize the capabilities of the car. I can’t take the turns at the optimal speed and distance and path. The car doesn’t win by itself.

Put the two things together, however, and now you have a winning formula. That’s the symbiotic relationship between Nvidia and TSMC. The excellence of each drives the excellence of the other.

Now, back to TSMC and the foundries…

What makes one chip better than another?

I told you that you’d soon be even more impressed with the difficulty of manufacturing chips. Here’s why.

Chips are categorized by the size of their transistors. As briefly mentioned in the last article, the smaller the transistor → the more transistors can fit on a chip → the more powerful the chip is. Moore’s Law is a prediction that the number of transistors on a chip will double roughly every year, driving improvements in compute power and efficiency. Foundries are constantly competing to manufacture wafers with smaller and smaller transistors.

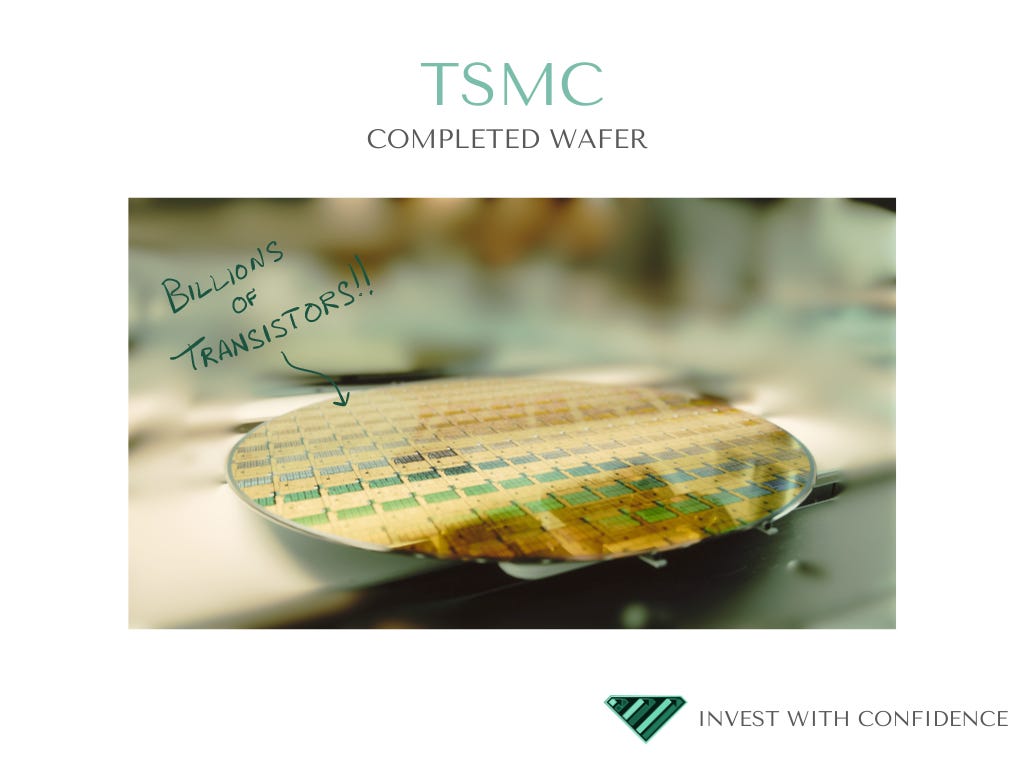

What is the size of our transistors today? The most advanced chips today have 3 NM transistors. 3 nanometers! That’s 1/20,000th the size of a human hair!

Think back to the manufacturing process we talked about, and hopefully you’ll gain more appreciation for the process. The complex technological feat is working with components on the order of nanometers! A single chip can have tens of billions of transistors in a few square inches of space. That’s unreal.

Why is TSMC the best foundry in the world?

Ok, now we have enough background to appreciate the difficulty of the problem. Let’s talk about what makes TSMC so good at its job:

Manufacturing excellence. It all starts here. Without this, there’s no discussion to be had. Simply put, TSMC just continues to deliver the highest quality product at a massive scale. They utilize tons of proprietary technologies in their stacking, packaging, and processing of chips. One notable technology, called 3DFabric, allows customers greater flexibility in their chip design, and is a strong competitive advantage. When it’s easy for customers to ask for exactly what they want, and then TSMC can deliver exactly what was asked for, it creates a harmonious partnership. Why would a customer walk away from that?

Excellent leadership. I was really impressed the more I learned about TSMC’s leadership. There’s three people I want to talk about:

Morris Chang, founder of TSMC. He studied mechanical engineering at MIT, then got a PhD in electrical engineering from Stanford. He learned from the best of the best in the US, recognized the opportunity and potential growth for chip manufacture, and built a behemoth from the ground up.

Mark Liu, who joined the company in 1993, and rose to become Chairman in 2018 after Chang retired. He has a PhD in computer science, and kickstarted a strategy to head off one of TSMC’s biggest risks, which we’ll talk about in a later section.

CC Wei, who got a PhD in electrical engineering from Yale and then joined the company in 1998. He rose from SVP → EVP & COO → President & CEO (in 2018 after Chang retired) → CEO & Chairman (in 2024 after Liu retired).

There’s two things I really love here. First, the leaders have deep technical knowledge, which is critical when building such a technical product. They know where the value comes from, and won’t make the wrong tradeoffs that compromise TSMC’s product quality for the sake of the short-term bottom line. Second, internal promotions for Liu and Wei show that the company does a good job of growing and retaining talent, which creates long-term stability in vision, strategy and execution. Since the two took over for Chang in 2018, TSMC’s value has roughly tripled, and they’ve become the most valuable company in all of Asia. Chances are, Wei won’t make drastic changes to a playbook that he’s helped build and that has had such proven success.

Dedicated foundry model. One of TSMC’s core tenets is that they will only manufacture chips, never design them. They are constantly telling this to their customers, to their investors, to anyone who will listen. This sends a clear message that they’re not trying to compete with their customers, which in turn engenders a lot of loyalty. Contrast this to Intel and Samsung, who are IDMs as mentioned before. Other chip design companies are reluctant to provide their designs to Intel / Samsung to manufacture, because what if the designs are shared across divisions within the IDM? In theory, Intel / Samsung are not supposed to share information across divisions, but would you trust the entire intellectual property of your company to that? If you were Apple, would you send your chip designs to Samsung, one of your biggest competitors in all of computing? TSMC has said clearly that they’re going to do one thing and one thing only. And they’re going to do it better than anyone else in the world.

Yield rate. This term refers to the percentage of manufactured chips that are usable. Because of the complexity of the process, foundries can’t guarantee that 100% of the wafers were produced perfectly. So it’s an accepted reality in the industry that only a subset of those chips will work as intended. The yield rate is different for each size of chip (5 NM, 4 NM, 3 NM, etc), but TSMC’s ranges from 60-80%. In contrast, Samsung had an overall yield rate of 35% in 2022. Their more advanced chips, the 3 NM, were at just 30%. Intel, even worse, didn’t release numbers because they were so abysmal.

Not a one-trick pony. TSMC doesn’t produce chips to support just the AI boom. Their chips are used everywhere in the world, from fighter jets and automobiles to mobile phones and AC units. A collapse in demand for GPUs and AI would certainly hurt their bottom line, but it wouldn’t cripple them. The entire modern world runs on TSMC chips.

What is some evidence that TSMC’s chips are the best?

Here are some fun facts and stories that highlight TSMC’s dominance over other foundries:

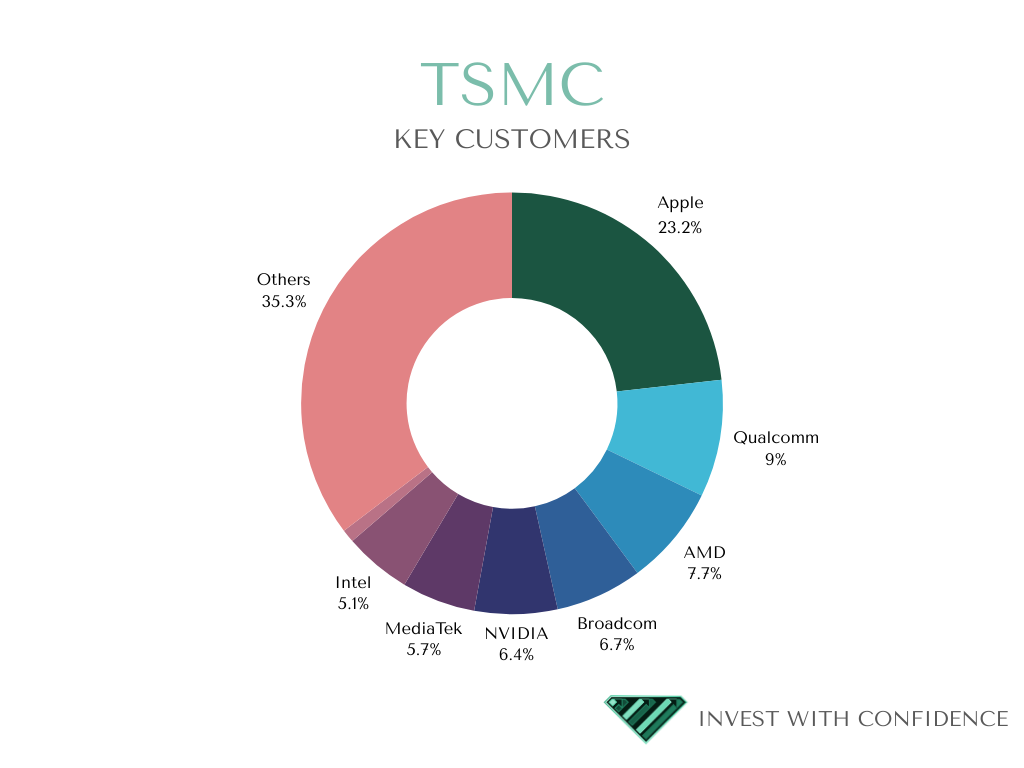

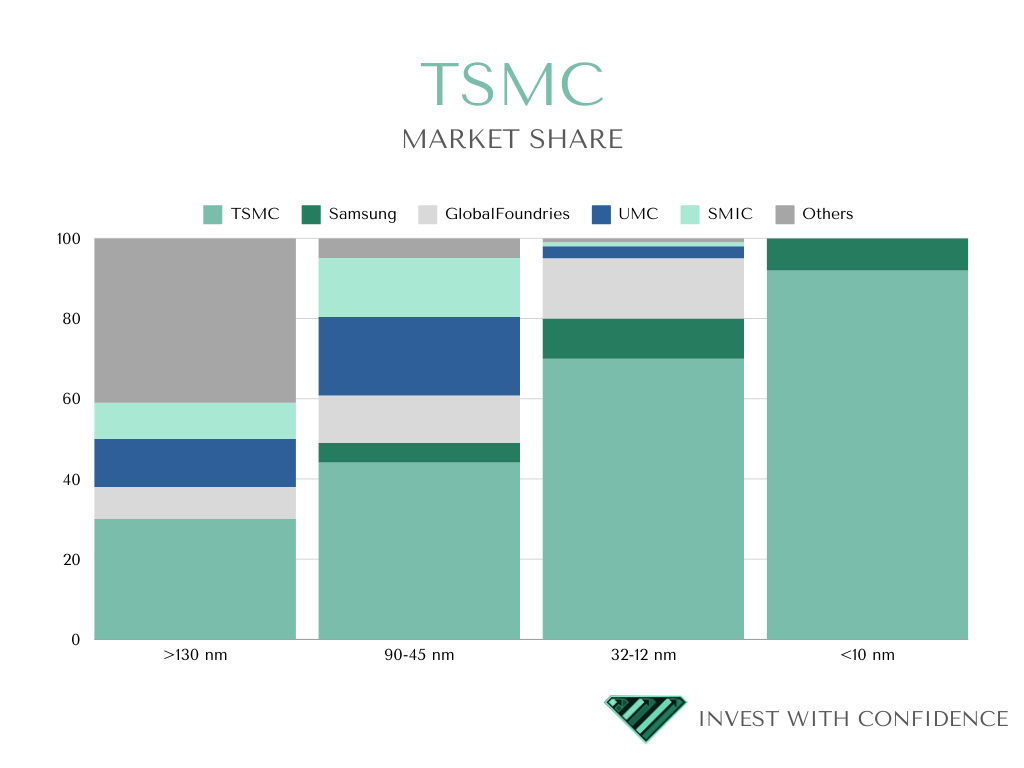

Over 60% of the global supply of chips are produced by TSMC. One company is basically powering the world’s electronics!

There’s a subset of chips that are colloquially called “advanced”, which is referring to chips with smaller than 10 NM transistors. These advanced chips are used for high-performance computing (HPC) applications like AI, crypto and gaming. Of this subset of chips, over 92% are produced by TSMC. That’s so incredible that I had to double check my numbers. All of the modern advancements in HPC can be traced back, in one form or another, to a single company in Taiwan. Crazy!

Apple gets all of its silicon chips for Macs, iPads, iPhones, etc from TSMC. In fact, when TSMC was commercializing its production of 3 NM chips, Apple bought every single available chip that was produced. In other words, the most valuable company in the world took every single TSMC chip it could get its hands on for an entire year. That’s a vote of confidence if I’ve ever seen one.

In 2023, TSMC produced 11,895 different products using 288 different process technologies to serve hundreds of customers. That’s a sign of a very mature engineering process.

Based on import records, it looks like (but is not confirmed) that Google’s next suite of AI chips will be manufactured by TSMC. Google had been using Samsung since 2021, but the quality and quantity was not up to spec, so it looks like they’ll be switching. Considering the partnership that Google and Samsung have, this would be a devastating referendum on Samsung’s ability to compete with TSMC.

US, Japan and Europe have given billions in government money to subsidize new TSMC factories in their countries. They all want to bring some chip manufacturing on-shore. But they didn’t each pick different foundries to entice - they all went for the juggernaut. That says something about their level of confidence in the technology, leadership and longevity of TSMC.

Here’s a mind-boggling story. Intel has started outsourcing some of its chip production to TSMC because it simply couldn’t compete. Imagine going to a Pizza Hut, placing an order, and then they hand you a Dominos pizza. They shrug and say, “we can’t make it that well, so we just use our competitor’s product.” That would be absurd, yet that’s exactly what’s happening here.

What are the risks to their product dominance?

A company with such a stranglehold on global chip production is not without risks. Let’s talk about those:

Geopolitical tensions in the region. This is by far the biggest and most obvious risk to TSMC’s continued success. Taiwan, where TSMC is headquartered, is a disputed territory - China claims ownership over the island, while the US supports Taiwan’s independence. The island is frequently a source of contention between the two global superpowers, and it can often feel like we’re a bad day away from China invading. Warren Buffet said TSMC is one of the best companies in the world, but cited geopolitical tensions as his biggest concern - enough so, that he actually sold his stake. I don’t deny the geopolitical tensions, but I have a different interpretation of the matter. The chain reaction from a China invasion of Taiwan would start by crippling TSMC, and then would cascade to Apple, Google, Microsoft, auto makers, military defense contractors, consumer electronics. The global economy would be devastated, at which point the US wouldn’t just sit around and say “oh well”. In short, if China invaded Taiwan, we’d have much bigger problems than a company or two in isolation - we’d have a global conflict4 . It’s up to you as an investor to understand your own risk appetite and strategy. Personally, I don’t build my strategy around black swan events, so I’m willing to accept the risk. To each their own though.

The race for the 2 NM chip. With each size iteration (4 NM → 3 NM → etc), there are new challenges that must be overcome to successfully commercialize the production process. Currently, Intel, Samsung and TSMC are racing to create the 2 NM chip at scale. TSMC has a significant head start and much better prospects, but if there was ever a time for the others to catch up, it would be now.

Customers wanting more suppliers to choose from. It’s a common refrain that customers grumble about TSMC’s stranglehold on chip production, but it seems more like a negotiation play than like a real concern. These customers haven’t taken their business elsewhere; in fact, they’ve grown their orders at TSMC consistently. TSMC also has a reputation for not price-gouging their customers. Overall, I think this risk is not a big deal.

Production issues with new chip architectures. News recently came out that Nvidia’s new chip architecture, Blackwell, is delayed into 2025 because of production issues at the TSMC plant. Specifically, a new packaging technology called CoWoS-L has had failures in the production line. This is meaningful because TSMC has been working on this technology for a while, has pushed customers to adopt it, and now has failed to deliver. If they’re unable to overcome these challenges, it could pose a blow to future growth. To understand the potential impact, I looked back to see how they’d dealt with previous production issues:

2011-12: Production of new 28 NM chips was hamstrung by low yield. Investors and customers were frustrated and concerned (much more than today) and even voiced their doubts publicly. In the short term, TSMC stock was negatively impacted, but they improved the yield over time and the story faded into the background.

2013-15: Once again, a new transistor size (16 NM) had low yields, and once again, analysts predicted that TSMC might lose its position as the market leader because of these stumbles. But the company responded so well, so impressively - they made multiple design changes during production, in a short time - that in fact their dominance over the market was cemented. This is a confidence booster because it shows that TSMC can successfully make design changes to quickly address problems.

2019: TSMC was making the first chip (7 NM) using EUV (extreme ultraviolet) technology. It had problems, but everyone was expecting some speed bumps along the road, so it didn’t have a negative impact on the company’s perception or stock. They eventually learned how to harness the full power of EUV technology, and proceeded to innovate even faster than before.

The only key difference I see from previous production issues is that this time TSMC left themselves basically no room for error. Things have been going so well for so long, that they may have gotten complacent and thought that they wouldn’t run into any issues when migrating to new technology. That, as a mentality, is a bit concerning to me.

Trying to do too much at once. If none of the above risks really scare me by themselves, it’s the combination of everything at once that is cause for concern. Is TSMC biting off more than it can chew? Geographic expansion, new packaging technology (CoWoS-L) for Nvidia’s Blackwell chip, the race for 2 NM commercial production. All of this under the specter of geopolitical tensions, and they’ve baked no margin of error into their most aggressive timelines yet. I worry that TSMC is like a juggler with too many balls in the air. If they pull off the trick, then it’s amazement and awe from everyone. But one slip up, and there could be a cascading effect across the business.

Takeaways from the product section

TSMC has combined engineering excellence with leadership excellence, a combination that’s absolutely devastating to their competitors. Their dominance is apparent everywhere I look, and customers have serious loyalty to them. It’s almost unbelievable how this one company is so important to the modern digital economy.

The risks are real too. Taken individually, it might not be so bad, but collectively I worry that TSMC might be trying to do too much. It remains to be seen whether they can pull it off.

What’s next then? A company this important must have bulletproof financials, right?

Not so fast. There’s a surprise in store for us next week when we look at the numbers. Continue the journey here:

Thoughts? Comments? Know what the surprise could be? Share in the comments below!

⚠️ This is not investment advice.

1 In the US stock markets, the company trades under the ticker TSM.

2 Spoiler alert: we’ll be looking at equipment manufacturers in the next article, with a focus on ASML.

3 Fun fact: silicon is a top 10 available mineral in the world, so we’re not in danger of running out of it any time soon.

4 In a bit of dark humor, some locals in Taiwan refer to TSMC as “national protection mountain”. They’re referring to how the global importance of the company helps deter a Chinese invasion.

Reply